Download PDF

Advanced Analytics for Accurate Currency Demand Forecasting in South-East Asian Central Bank

Applicable Industries

- Finance & Insurance

- Retail

Use Cases

- Demand Planning & Forecasting

- Inventory Management

The Challenge

The largest central bank in South-East Asia was facing challenges in accurately forecasting the demand for banknotes and coins of different denominations. The rapidly changing economic landscape and extraneous shock events such as elections and demonetization were causing most of the existing algorithms to fail. The bank also needed to account for significant developments in the applications of electronic technologies in the retail payments areas. Additionally, the bank wanted to understand the numbers for replacements or retirements of banknotes and the effect of different shock events on currency demand.

About The Customer

The customer is the largest central bank in South-East Asia. They are responsible for a range of national level economic policies, including liquidity management, currency issuable, financial supervision, foreign currency reserves, and exchange rate policy. The bank plays a crucial role in the economic stability of the region and is constantly dealing with the challenges of a rapidly changing economic landscape, including the increasing use of electronic technologies in retail payments and extraneous shock events such as elections and demonetization.

The Solution

Datamatics provided a solution that did not solely rely on structural relationships between money and other nominal or real variables. They explored econometric time series based algorithmic interventions and implemented advanced analytics solutions. A user-friendly solution was developed using R and Dot Net framework, which utilized Econometric Time-Series Forecast modelling and the analysis of 10 years of data for Banknote and Coin requirement. The data was extracted from four different sources – Withdrawal, Retirement, Buffer Stock, and Currency-in-Circulation. The solution used concurrent, multiple model engagement for building precision and accuracy, and had the ability to handle shock events seamlessly and effectively. Both long and short term estimations were significantly more precise and accurate compared to other competing and erstwhile estimates.

Operational Impact

Quantitative Benefit

Related Case Studies.

Case Study

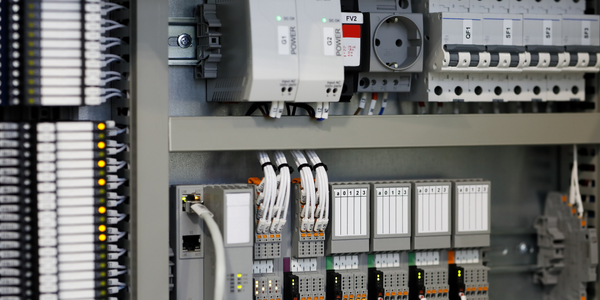

Improving Production Line Efficiency with Ethernet Micro RTU Controller

Moxa was asked to provide a connectivity solution for one of the world's leading cosmetics companies. This multinational corporation, with retail presence in 130 countries, 23 global braches, and over 66,000 employees, sought to improve the efficiency of their production process by migrating from manual monitoring to an automatic productivity monitoring system. The production line was being monitored by ABB Real-TPI, a factory information system that offers data collection and analysis to improve plant efficiency. Due to software limitations, the customer needed an OPC server and a corresponding I/O solution to collect data from additional sensor devices for the Real-TPI system. The goal is to enable the factory information system to more thoroughly collect data from every corner of the production line. This will improve its ability to measure Overall Equipment Effectiveness (OEE) and translate into increased production efficiencies. System Requirements • Instant status updates while still consuming minimal bandwidth to relieve strain on limited factory networks • Interoperable with ABB Real-TPI • Small form factor appropriate for deployment where space is scarce • Remote software management and configuration to simplify operations

Case Study

How Sirqul’s IoT Platform is Crafting Carrefour’s New In-Store Experiences

Carrefour Taiwan’s goal is to be completely digital by end of 2018. Out-dated manual methods for analysis and assumptions limited Carrefour’s ability to change the customer experience and were void of real-time decision-making capabilities. Rather than relying solely on sales data, assumptions, and disparate systems, Carrefour Taiwan’s CEO led an initiative to find a connected IoT solution that could give the team the ability to make real-time changes and more informed decisions. Prior to implementing, Carrefour struggled to address their conversion rates and did not have the proper insights into the customer decision-making process nor how to make an immediate impact without losing customer confidence.

Case Study

Digital Retail Security Solutions

Sennco wanted to help its retail customers increase sales and profits by developing an innovative alarm system as opposed to conventional connected alarms that are permanently tethered to display products. These traditional security systems were cumbersome and intrusive to the customer shopping experience. Additionally, they provided no useful data or analytics.

Case Study

Real-time In-vehicle Monitoring

The telematic solution provides this vital premium-adjusting information. The solution also helps detect and deter vehicle or trailer theft – as soon as a theft occurs, monitoring personnel can alert the appropriate authorities, providing an exact location.“With more and more insurance companies and major fleet operators interested in monitoring driver behaviour on the grounds of road safety, efficient logistics and costs, the market for this type of device and associated e-business services is growing rapidly within Italy and the rest of Europe,” says Franco.“The insurance companies are especially interested in the pay-per-use and pay-as-you-drive applications while other organisations employ the technology for road user charging.”“One million vehicles in Italy currently carry such devices and forecasts indicate that the European market will increase tenfold by 2014.However, for our technology to work effectively, we needed a highly reliable wireless data network to carry the information between the vehicles and monitoring stations.”

Case Study

Ensures Cold Milk in Your Supermarket

As of 2014, AK-Centralen has over 1,500 Danish supermarkets equipped, and utilizes 16 operators, and is open 24 hours a day, 365 days a year. AK-Centralen needed the ability to monitor the cooling alarms from around the country, 24 hours a day, 365 days a year. Each and every time the door to a milk cooler or a freezer does not close properly, an alarm goes off on a computer screen in a control building in southwestern Odense. This type of alarm will go off approximately 140,000 times per year, equating to roughly 400 alarms in a 24-hour period. Should an alarm go off, then there is only a limited amount of time to act before dairy products or frozen pizza must be disposed of, and this type of waste can quickly start to cost a supermarket a great deal of money.