Download PDF

AI Improves Overall Business Relationships for Jewelers Mutual

Technology Category

- Analytics & Modeling - Predictive Analytics

- Platform as a Service (PaaS) - Data Management Platforms

Applicable Industries

- Retail

Applicable Functions

- Business Operation

- Sales & Marketing

Use Cases

- Predictive Maintenance

Services

- Data Science Services

- System Integration

The Challenge

Jewelers Mutual, a leading provider of insurance for jewelers and consumers in the United States and Canada, recognized the need to invest in analytics, AI, and machine learning to improve overall customer experiences. Their business relies on effectively protecting their jeweler customers’ businesses and providing personal insurance directly to consumers with innovative customer experiences. They collected data from losses, customers, and multiple other sources which weren’t tapped into before. They started their AI journey a few years ago by implementing Gradient Boosting Machine, and then moving to an AutoML solution from DataRobot. However, they realized that they needed greater transparency of a solution and needed to have an explainable AI component.

About The Customer

Jewelers Mutual is one of the United States’ and Canada’s most established and trusted providers of affordable and comprehensive insurance for jewelers and consumers. As a leader in driving customer-focused innovation and providing the latest technology to a long-standing industry, Jewelers Mutual uses H2O-3 open source and H2O Driverless AI to deliver exceptional customer experiences, prevent losses, and provide better protection and policies for both jewelers and consumers. The H2O.ai platforms have helped the company build unique models and recalibrate its rating systems based on the additional customer data generated, making its insurance rates more competitive.

The Solution

After evaluating multiple solutions, Jewelers Mutual determined that H2O Driverless AI offered the right level of transparency, and had the advanced capability to explain and understand their models, with machine learning interpretability. Their first deployed model helped commercial underwriters understand their customers better and provided the reason codes as to why decisions were made using the machine learning interpretability capability. These insights then were made available through a web app to the underwriters. The interpretability and explainability of Driverless AI was instrumental in convincing the business stakeholders and also in making their own data scientists understand the algorithms better. They also found the H2O.ai community very helpful through the journey. Lastly, they found that deploying models using Driverless AI’s automatic deployment capability (MOJOs) made their data science efforts faster and easier.

Operational Impact

Related Case Studies.

Case Study

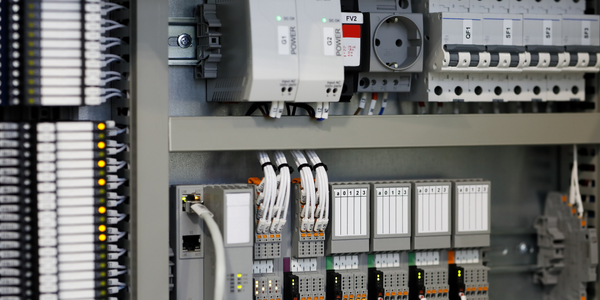

Improving Production Line Efficiency with Ethernet Micro RTU Controller

Moxa was asked to provide a connectivity solution for one of the world's leading cosmetics companies. This multinational corporation, with retail presence in 130 countries, 23 global braches, and over 66,000 employees, sought to improve the efficiency of their production process by migrating from manual monitoring to an automatic productivity monitoring system. The production line was being monitored by ABB Real-TPI, a factory information system that offers data collection and analysis to improve plant efficiency. Due to software limitations, the customer needed an OPC server and a corresponding I/O solution to collect data from additional sensor devices for the Real-TPI system. The goal is to enable the factory information system to more thoroughly collect data from every corner of the production line. This will improve its ability to measure Overall Equipment Effectiveness (OEE) and translate into increased production efficiencies. System Requirements • Instant status updates while still consuming minimal bandwidth to relieve strain on limited factory networks • Interoperable with ABB Real-TPI • Small form factor appropriate for deployment where space is scarce • Remote software management and configuration to simplify operations

Case Study

How Sirqul’s IoT Platform is Crafting Carrefour’s New In-Store Experiences

Carrefour Taiwan’s goal is to be completely digital by end of 2018. Out-dated manual methods for analysis and assumptions limited Carrefour’s ability to change the customer experience and were void of real-time decision-making capabilities. Rather than relying solely on sales data, assumptions, and disparate systems, Carrefour Taiwan’s CEO led an initiative to find a connected IoT solution that could give the team the ability to make real-time changes and more informed decisions. Prior to implementing, Carrefour struggled to address their conversion rates and did not have the proper insights into the customer decision-making process nor how to make an immediate impact without losing customer confidence.

Case Study

Digital Retail Security Solutions

Sennco wanted to help its retail customers increase sales and profits by developing an innovative alarm system as opposed to conventional connected alarms that are permanently tethered to display products. These traditional security systems were cumbersome and intrusive to the customer shopping experience. Additionally, they provided no useful data or analytics.

Case Study

Ensures Cold Milk in Your Supermarket

As of 2014, AK-Centralen has over 1,500 Danish supermarkets equipped, and utilizes 16 operators, and is open 24 hours a day, 365 days a year. AK-Centralen needed the ability to monitor the cooling alarms from around the country, 24 hours a day, 365 days a year. Each and every time the door to a milk cooler or a freezer does not close properly, an alarm goes off on a computer screen in a control building in southwestern Odense. This type of alarm will go off approximately 140,000 times per year, equating to roughly 400 alarms in a 24-hour period. Should an alarm go off, then there is only a limited amount of time to act before dairy products or frozen pizza must be disposed of, and this type of waste can quickly start to cost a supermarket a great deal of money.

Case Study

Supermarket Energy Savings

The client had previously deployed a one-meter-per-store monitoring program. Given the manner in which energy consumption changes with external temperature, hour of the day, day of week and month of year, a single meter solution lacked the ability to detect the difference between a true problem and a changing store environment. Most importantly, a single meter solution could never identify root cause of energy consumption changes. This approach never reduced the number of truck-rolls or man-hours required to find and resolve issues.