Download PDF

LTCG Streamlines Claims Processing with Nintex’s Full-Cycle Automation

Applicable Industries

- Finance & Insurance

- Life Sciences

Use Cases

- Leasing Finance Automation

- Material Handling Automation

Services

- Cloud Planning, Design & Implementation Services

The Challenge

Long Term Care Group (LTCG), a leading provider of business process outsourcing for the insurance industry, was facing a significant challenge in managing its day-to-day operations. A large proportion of LTCG’s work was based on handwritten documents such as notes and faxes, which required labor-intensive, manual efforts to process. These tasks were not only repetitive and time-consuming but also prone to human error. Furthermore, LTCG uses a proprietary software solution to interface with corporate insurance clients, adding an extra layer of complexity to the situation. Compatibility with this solution was a key prerequisite for LTCG when adopting new technologies. The company was in dire need of a solution that was straightforward to implement, very reliable, and easy to scale up at a later date.

About The Customer

Long Term Care Group (LTCG) is a leading provider of business process outsourcing for the insurance industry. The company manages complex long-term care portfolios to maximize financial performance. LTCG has more than 1.4 million long-term care policies currently under its management, representing nearly 20% of all active policies. The company serves over 50 national carriers, including every one of the top 10 insurers in the long-term care market. Based in the United States, LTCG is a significant player in the Health & Life Sciences industry.

The Solution

LTCG turned to Nintex’s full-cycle automation suite powered by AWS cloud to streamline their insurance billing and claims processing procedures. The company opted to use Nintex’s unique process discovery tool, part of the Nintex full-cycle automation suite, to identify further processes to automate in the insurance applications, billing/administration, and claims processing domains. The Full-Cycle Automation Suite is platform and application agnostic, meaning that it would have no trouble integrating seamlessly with LTCG’s existing proprietary software. In under two weeks, 83 unique processes were discovered and seven of these were rapidly automated. As a result, LTCG realized an improvement of up to 70% proficiency in claims processing, with human error practically eliminated.

Operational Impact

Quantitative Benefit

Related Case Studies.

Case Study

Real-time In-vehicle Monitoring

The telematic solution provides this vital premium-adjusting information. The solution also helps detect and deter vehicle or trailer theft – as soon as a theft occurs, monitoring personnel can alert the appropriate authorities, providing an exact location.“With more and more insurance companies and major fleet operators interested in monitoring driver behaviour on the grounds of road safety, efficient logistics and costs, the market for this type of device and associated e-business services is growing rapidly within Italy and the rest of Europe,” says Franco.“The insurance companies are especially interested in the pay-per-use and pay-as-you-drive applications while other organisations employ the technology for road user charging.”“One million vehicles in Italy currently carry such devices and forecasts indicate that the European market will increase tenfold by 2014.However, for our technology to work effectively, we needed a highly reliable wireless data network to carry the information between the vehicles and monitoring stations.”

Case Study

Safety First with Folksam

The competitiveness of the car insurance market is driving UBI growth as a means for insurance companies to differentiate their customer propositions as well as improving operational efficiency. An insurance model - usage-based insurance ("UBI") - offers possibilities for insurers to do more efficient market segmentation and accurate risk assessment and pricing. Insurers require an IoT solution for the purpose of data collection and performance analysis

Case Study

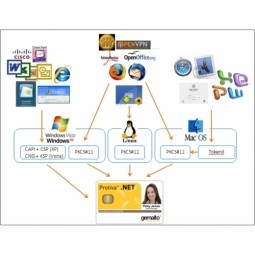

Corporate Identity Solution Adds Convenience to Beckman Coulter

Beckman Coulter wanted to implement a single factor solution for physical and remote logical access to corporate network. Bechman Coulter's users were carrying smart card badges for doors, but also needed a one-time password token to access to our corporate network when they were not in the office. They wanted to simplify the process.

Case Study

Smooth Transition to Energy Savings

The building was equipped with four end-of-life Trane water cooled chillers, located in the basement. Johnson Controls installed four York water cooled centrifugal chillers with unit mounted variable speed drives and a total installed cooling capacity of 6,8 MW. Each chiller has a capacity of 1,6 MW (variable to 1.9MW depending upon condenser water temperatures). Johnson Controls needed to design the equipment in such way that it would fit the dimensional constraints of the existing plant area and plant access route but also the specific performance requirements of the client. Morgan Stanley required the chiller plant to match the building load profile, turn down to match the low load requirement when needed and provide an improvement in the Energy Efficiency Ratio across the entire operating range. Other requirements were a reduction in the chiller noise level to improve the working environment in the plant room and a wide operating envelope coupled with intelligent controls to allow possible variation in both flow rate and temperature. The latter was needed to leverage increased capacity from a reduced number of machines during the different installation phases and allow future enhancement to a variable primary flow system.

Case Study

Automated Pallet Labeling Solution for SPR Packaging

SPR Packaging, an American supplier of packaging solutions, was in search of an automated pallet labeling solution that could meet their immediate and future needs. They aimed to equip their lines with automatic printer applicators, but also required a solution that could interface with their accounting software. The challenge was to find a system that could read a 2D code on pallets at the stretch wrapper, track the pallet, and flag any pallets with unread barcodes for inspection. The pallets could be single or double stacked, and the system needed to be able to differentiate between the two. SPR Packaging sought a system integrator with extensive experience in advanced printing and tracking solutions to provide a complete traceability system.

Case Study

Embracing Business Success in Real Time

· Increase control over growing Big Data to improve business decisions · Manage data for 28,000 biotechnology stockkeeping units in the fields of microbiology, molecular biology, animal cell cultures, plant tissue cultures, and lab ware for laboratory chemicals · Accelerate report generation and analysis with real-time data