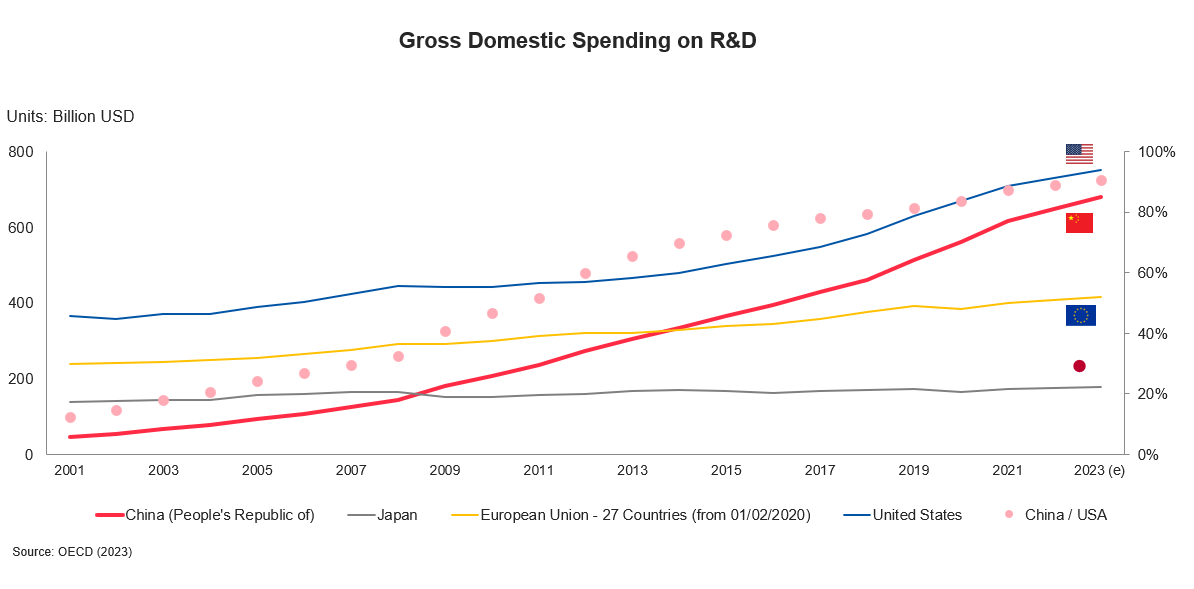

Over the past fifteen years, China has ramped up its spending on research and development (R&D), surpassing Japan in 2009 and steadily narrowing the gap with the U.S. In 2023, China’s R&D investment was at an estimated 91% of U.S. levels, according to the OECD, a clear signal of the country’s strategic commitment to becoming a global tech powerhouse. This drive has dwarfed the spending levels of Japan and the E.U.

Today China has established itself as a leader in global research across nearly 90% of critical technologies, spanning sectors like advanced materials, AI, energy, biotechnology, and defense-related technologies. According to the Australian Strategic Policy Institute (ASPI), a think tank that tracks tech competitiveness, this dominance places China significantly ahead of other nations.

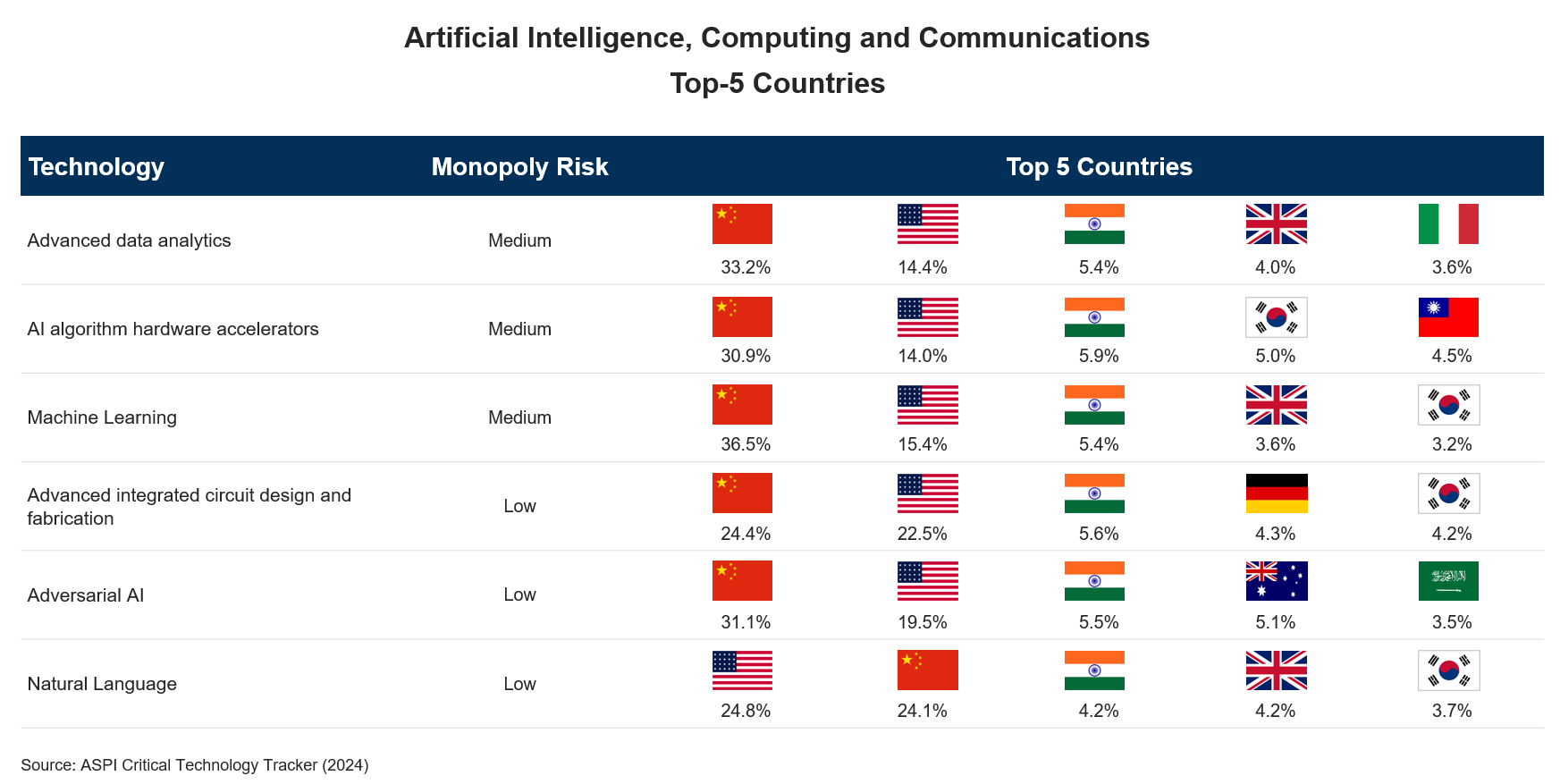

China leads in AI subfields like machine learning, advanced data analytics, and hardware accelerators. Despite fundamentally different innovation ecosystems, only China has been able to keep pace with the U.S. in emerging AI-related fields.

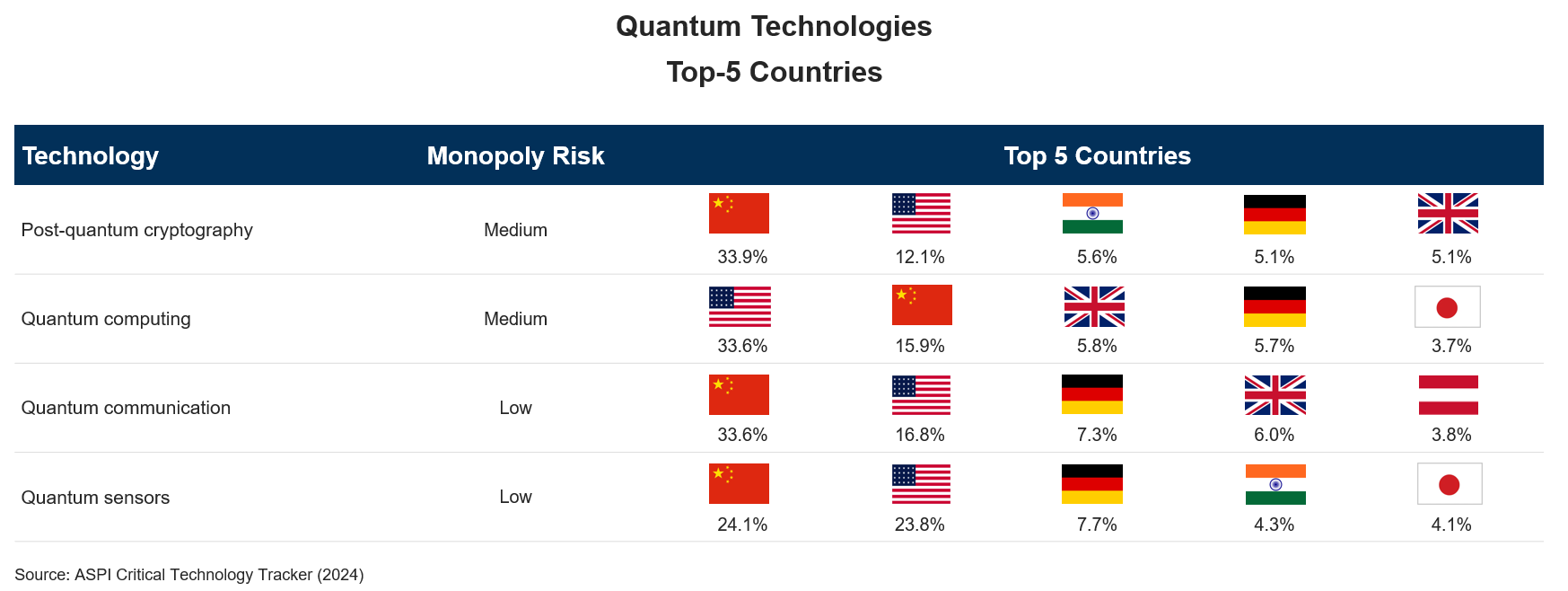

Quantum technologies are another stronghold, especially in quantum communication and post-quantum cryptography, both of which could secure China’s future communications infrastructure. However, China is lagging behind in Quantum computing, where the U.S. retains a distinct advantage.

Rethinking Competitiveness in the Face of China's Unique Growth Engine

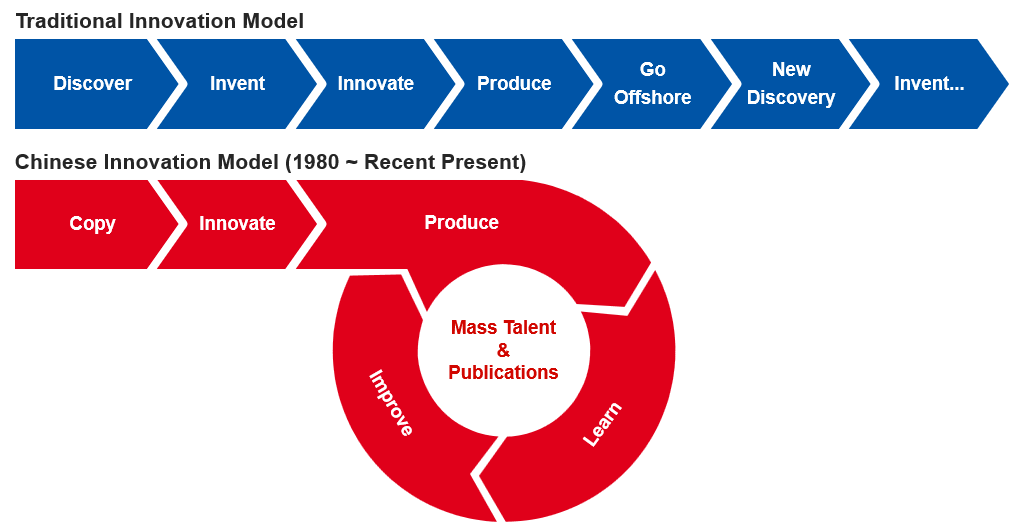

While traditional innovation models - as seen in Western economies - have historically led in innovation by fostering long-term discovery and invention, China’s model prioritizes rapid, high-impact innovation driven by an intricate blend of government policies, large-scale talent pools, and a hyper-competitive domestic market. This model, rooted in scale and speed, enables China to produce research with direct industrial applications and economic impact at a rate that Western nations struggle to match.

China’s model of high-impact research that supports its production and manufacturing innovations is highly effective for fields where scalability and refinement are key. Government-backed subsidies, fewer regulatory hurdles, and a hyper-efficient supply chain bolster China's capacity to produce and iterate on technological advancements faster than its Western counterparts. Unlike traditional innovation models, where intellectual property rights and antitrust regulations act as checks on corporate dominance, China’s regulatory flexibility and state-favored “national champions” allow for near-monopolistic market consolidation.

This approach has offered Chinese firms a platform to dominate both domestically and internationally in some sectors like electric vehicles, AI, and advanced manufacturing, where China has successfully translated its research output into market dominance. For example, China dominates the global market for electric vehicle (EV) batteries and supercapacitors and produces over 70% of the world’s electric batteries, with leading firms like CATL and BYD capturing substantial market shares. This market hold demonstrates China’s success in translating research into global industrial leadership.

However, for advanced fields that demand incremental innovation and foundational breakthroughs, such as quantum computing and advanced genetic engineering, the report indicates China often plays catch-up, requiring extended timelines to achieve parity. Despite increased Chinese publications, the U.S. leads in cumulative research impact in these two technologies. Foundational breakthroughs remain concentrated within the U.S. and E.U., where research institutions have established deep-rooted expertise and infrastructure that prioritize IP and scientific discovery over immediate production gains.

The Challenge of Talent Retention and Intellectual Knowhow

A unique aspect of China’s innovation push is its burgeoning talent pool, yet the country faces a dilemma regarding the retention of its top researchers.

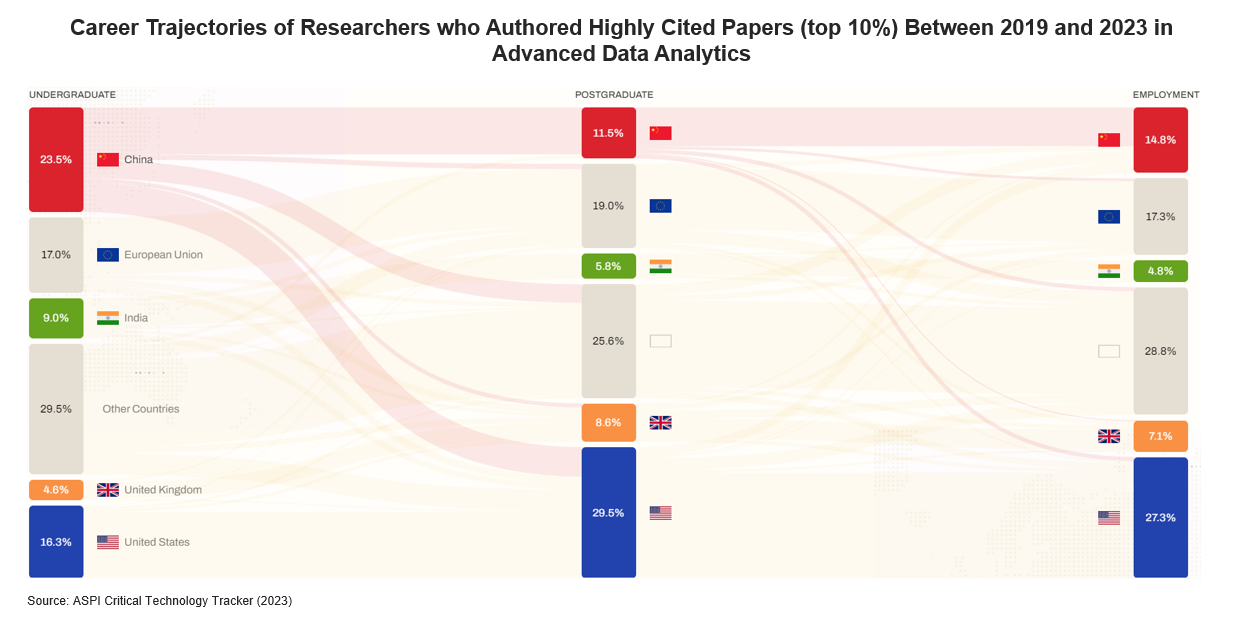

For now, China has managed to supply a continuous flow of talent through a blend of incentives and public-sector employment, especially in cutting-edge fields like AI hardware accelerators, electric batteries, or advanced data analytics. But the “brain drain” remains a challenge: many highly accomplished researchers choose to stay in the U.S. or E.U. after postgraduate training, drawn by better salaries and the appeal of working within established tech hubs.

Bridging Applied Research and Long-Term Innovation

As China continues to advance, its innovation model may require adaptation to sustain its global leadership. Bridging its strength in applied research with a stronger focus on long-term discovery and talent retention will be critical. By addressing these areas, China can solidify its technology leadership, balancing the immediate demands of industrial leadership with scientific contributions that secure its competitive edge in a rapidly changing global landscape.