Digitalization is a key driver for businesses to improve their operational efficiency, increase productivity, and stay competitive in the global marketplace. For industrial machine builders, the benefits of digitalization are particularly large since the competitiveness of their products depends heavily on objective criteria such as throughput, reliability, and durability. In many categories there is convergence around best practices in material specifications and hardware configuration. The next generation of competitive differentiation will hinge on their ability to integrate software to help customers improve production flexibility, reduce operating costs, improve uptime, and otherwise meet their operational excellence goals.

In industries such as automotive and electronics, OEMs have realized the importance of digitalization and have aggressively integrated software into their products. Hardware-software integration is often easier for consumer devices and equipment due to the high degree of product standardization. Standardization provides economies of scale for software development. Competitive differentiation is also shifting from hardware to software. For instance, car dealers are more likely to promote a vehicle’s entertainment system than horsepower to win a customer today.

On the other hand, industrial machine builders are just starting to realize the benefits of modern digital technology stacks. Of course, most machines are run on software. However, they often use static firmware that is difficult to update, has a terrible user interface, and is unconnected to higher level systems. There are good reasons for this divergence. Industrial equipment is often customized. Batch sizes are small. User experience takes a back seat to reliability and risk mitigation. Nonetheless, modern tech stacks present a significant opportunity for machine builders to differentiate around their software solutions.

The goal of machine builders should not be to push the boundaries of digitalization. Let Apple and Tesla do that. The goal is to leverage their deep well of industrial domain expertise to build practical software solutions that solve real problems, while using modern architecture that is efficient, secure, and user-friendly.

Despite growing awareness of the benefits of digitalization, many machine builder hesitate to commit to modernizing their software architecture and business models. We understand that each business is unique. A one-size-fits-all approach to digital transformation is not feasible. The key to success is learning and building capabilities through small steps, with regular review and adjustment. Start small, but act fast.

Below we highlight how a leading PCB equipment manufacturer assessed their current situation, prioritized the solutions that provide the most value for their customers and internal users, and created an agile roadmap to kickstart their digital transformation. We were fortunate to partner with them as they built momentum and confidence. Our joint goal was to transition from a Business-to-Business (B2B) vendor model competing on specifications and pricing, towards a Business-for-Business (B4B) business model that competes based on a superior understanding of customer needs and the agility to quickly provide practical solutions.

Step 1: Understand your customers

The first step in the digitalization journey is finding out what your customers need. A common pitfall is committing to efforts that sound good in theory, but that no one needs. No matter how well-developed your solution might be, if you’re not solving a real problem, there will be no one to pick up the check.

This sounds intuitive. You sell to your customers, so don’t you already know them? In the case of this PCB OEM and many other manufacturers, the answer is no. Machine builders typically respond to requests for proposals and then interact with a very narrow set of customer stakeholders. These often include engineering and procurement, but not users. It is critical to take this further step and build relationships with the frontline teams that actually use your products.

In this particular case, we interviewed over 20 users from across North America, Europe, and Asia. In the interviews we never talked about our customers products. They weren’t the point. Instead, we focused on understanding their pain points and operational goals. We also spoke with internal users, such as commissioning and service teams. They often work hand-in-hand with customers to solve problems but they are seldom invited to participate in solution development.

Here, it’s essential to work systematically – you want to know what the pain points are, but also what the root of the issue is and how pain points impact different processes. You also need to assess the impact of different pain points on customers and your own organization. All pains are not equal, and the loudest voice is not necessarily the most important.

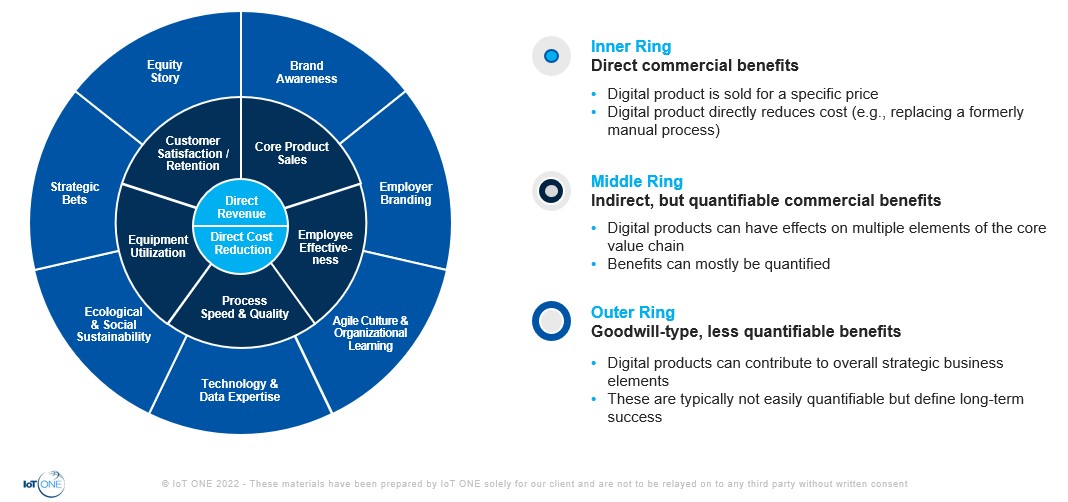

Next, you’ll also want to start thinking about your strategic focus. The digital value canvas (developed with our strategic partner Excubate) is helpful to initiate this thought process. Solving pain points can bring value to your organization in a variety of ways. By mapping pains to this canvas, you can prioritize the most significant opportunities.

[Digital Value Canvas]

Using a version of this model adapted to our client’s situation, we were able to clearly pinpoint the internal and external opportunity areas that should drive their digital strategy.

.jpg)

[high-level overview of internal pain point findings]

Step 2: Solution benchmarking

After assessing opportunities and defining initial priorities based on potential impact and company strategy, a better understanding of the competitive environment needs to be built. We worked with the PBC OEM to conduct benchmarking at three levels: technology providers, use cases and technologies, and business models.

To achieve new competitive advantages it’s essential to know what use cases your competitor, your customer and your customer’s customer are adopting, what technologies are required to enable them, and how they will impact your business. Our approach here was to:

- Develop a use case library and map uses cases to identified pain points

- Track adoption trends and solution maturity by industry segment

- Evaluate adoption impacts (operational and quantitative)

- Define alternative tech stacks and critical technologies for each use case

- Identify deployment challenges and risks

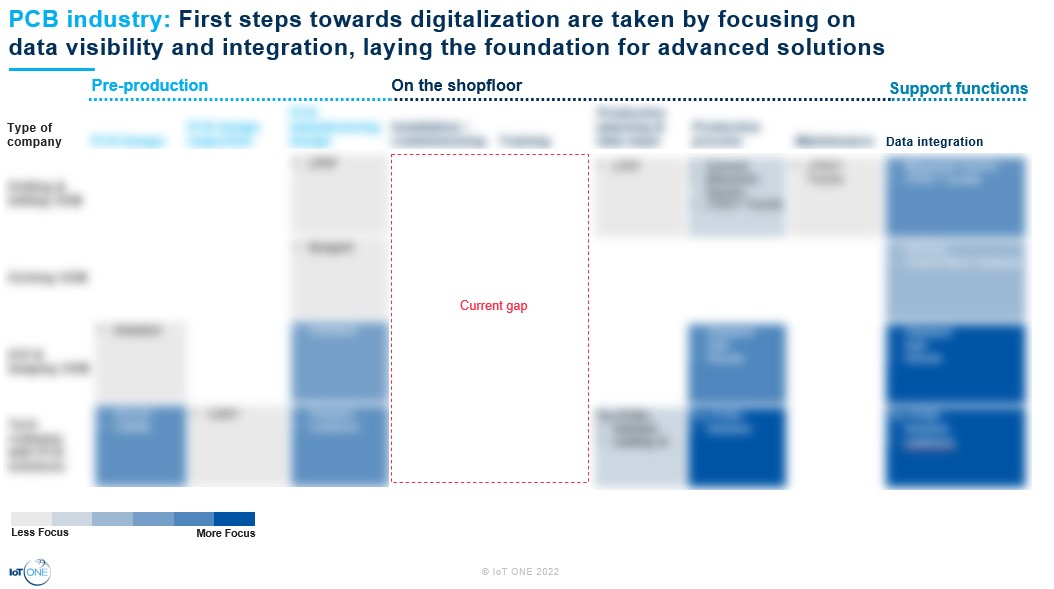

[high-level overview of industry benchmarking]

The PCB industry still features many manual processes and the degree of digitalization is relatively low throughout most pre-production and production steps. Tech conglomerates and software providers seemed to have realized this – several players had started to provide software solutions for the industry.

At this point, some machine builders might think: “How do we compete with these tech giants, we don’t have software competencies.” However, this negative outlook overlooks one essential point – as an equipment builder, you are the domain expert. You might not have competitive IT competencies, but you know the processes inside and out. You know what’s needed and how it has to be delivered. And once you’re done developing your offering, you can introduce it directly to your existing customer network.

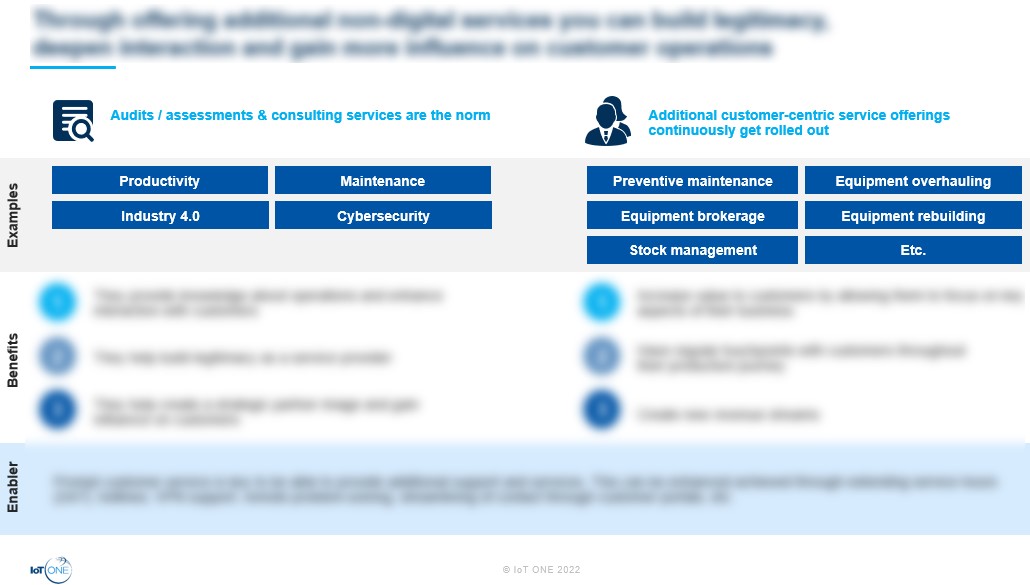

Therefore, we not only looked at direct competitors but also beyond to see what comparable machine builders were doing in terms of digitalization. Here, we deep dived on some players who are actively serving the automotive industry, an industry at the forefront of industrial digitalization. Jumping deeper into service portfolios and business models of best-in-class digitalizing machine builders, we found many interesting characteristics.

[Service portfolio of one best-in-class benchmark company]

Apart from company-specific services such as equipment brokerage and preventive maintenance, there were a couple of common success factors. One, proactivity in helping customers: unlike general B2B practice where you’re waiting for customers to come with you with problems, these machine builders have used knowledge they built up over time to advise clients in areas such as productivity, maintenance, digitalization, etc. Basically, what they’re saying is “Hey, we can offer you this equipment, but our expertise is much broader, should you need any help, we’re there for you”.

In exchange, these services then help them build relationships that extend beyond procurement and allow them to really understand their customers. This then brings us to number two – gaining insights into what operations, maintenance, engineering teams are struggling with. Companies are continuously rolling out both services and digital solutions to address these challenges, add value for their customers and build up new revenue streams.

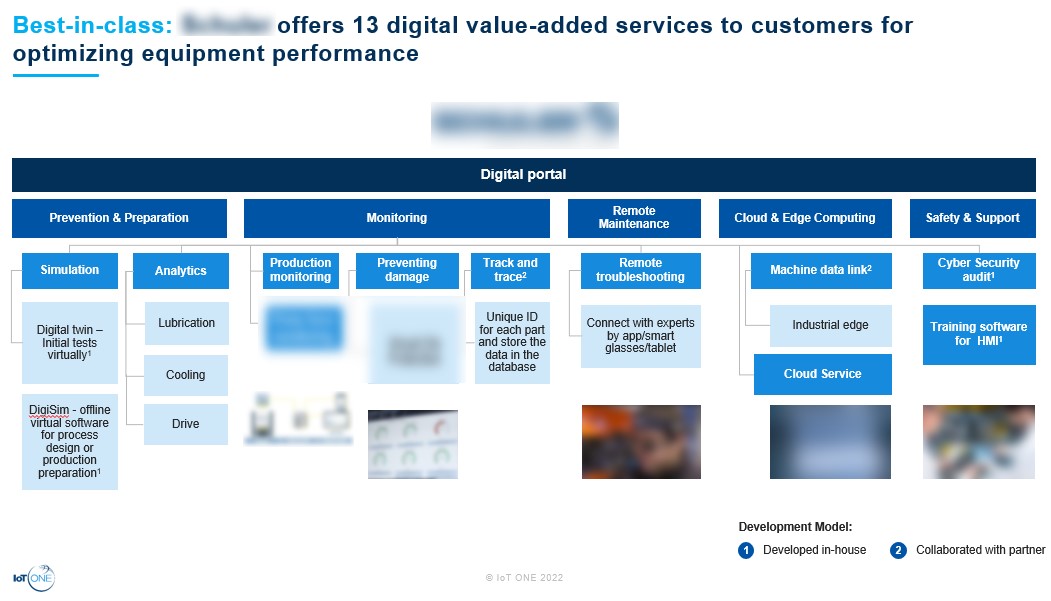

[high-level overview of best-in-class benchmark company’s digital solution portfolio]

In terms of external digital services, the right approach depends largely on internal competencies and industry characteristics. In the above example, the benchmarked company focused on fully optimizing their core machinery offering, offering solutions with use cases ranging from digital twin simulation before production, to monitoring manufacturing processes, tracing parts and outputting data into relevant systems and performing cybersecurity audits to support digitalization. Their strategy was to optimize their segment of the production process and make it easily to integrate with other systems. Depending on complexity of the overall production process, an alternative strategy could be moving further up or down the production process by collaborating with other machine builders to offer integrated solutions that could amplify value to customers, while charging package prices.

Our client refined the implementation plan by building awareness of customer needs and the strategies and tech stacks of best-in-class companies in adjacent industries. By further integrating market needs, benchmark insights and internal strategic goals, we worked with the client’s management team to map out several alternative digital portfolios and business models.

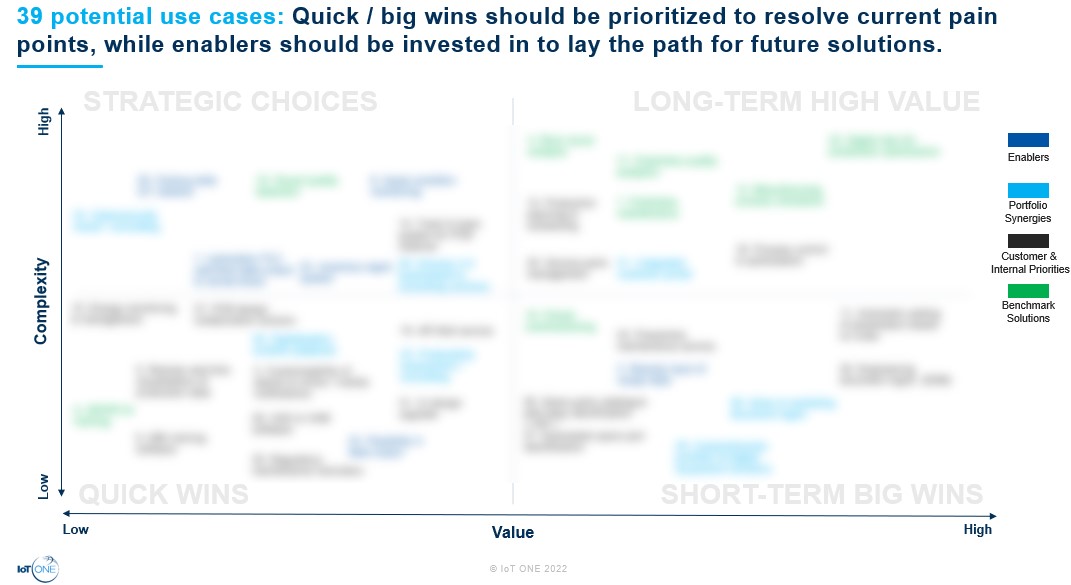

[Digital portfolio use case mapping]

Following this approach, our client identified an array of options to enhance their operations in the short- and long-term. These ranged from off-the-shelf software systems to support internal processes to integrated solutions for their customer’s manufacturing processes. The investment strategy relied on the return on investment from quick wins paying for the infrastructure to make longer-term investments in more ambitious solutions.

Step 3: Strategy definition & implementation planning

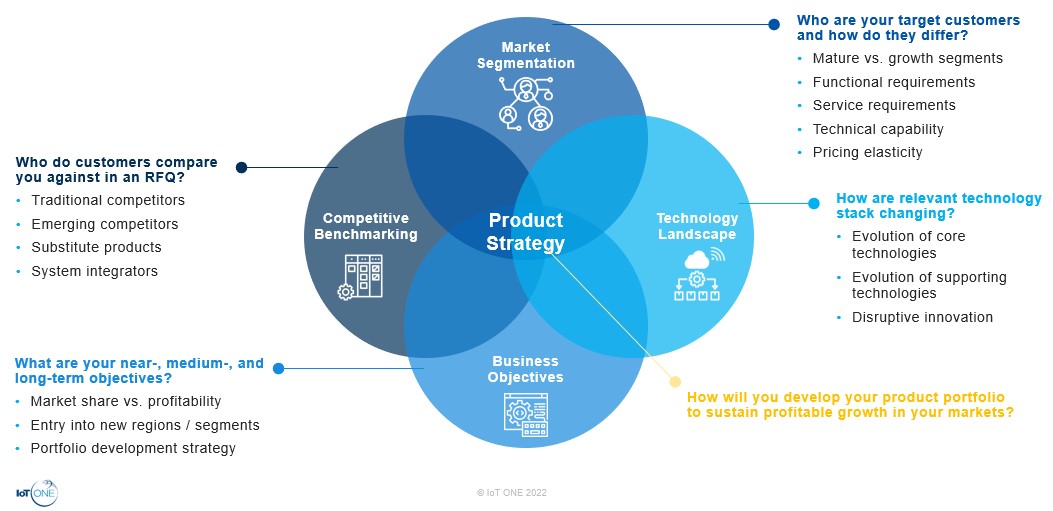

We next collaborated with the PCB OEM’s management team to define their digital portfolio strategy. This is a medium-sized business, so they did not have extra resources to play with. Practicality was of primary concern. We considered the following components:

- Product strategy: What portfolio differentiation will provide a sustainable competitive advantage? Which components are core and must be developed in-house or with strategic partners, and which can be outsourced?

- Revenue model: How will our revenue model maximize growth, retention, and profitability? What model will customers accept today, and what can they be led to accept over time?

- Prospecting strategy: Who are the right customers to prioritize as first adopters? How do we engage them effectively?

- Distribution strategy: How will we achieve superior distribution in competitive markets? Can our existing distribution channels service the new portfolio or do we need to develop new channels?

[Product strategy framework]

Knowing what you want to achieve is the first step in defining how you will arrive there. Developing everything in-house was impossible for this machine builder, as it is for most OEMs. Even if it were possible, it most likely would not make sense financially or competitively.

However, the decision of whether to build, buy or partner to acquire each element of the solution’s tech stack has far reaching consequences on competitiveness and profitability. Additionally, channel strategy (who to partner with and how) and data strategy (how the company will compete across the data value chain) are all impacted by solution development decisions.

At IoT ONE, we have assisted clients at every step of the digitalization process. Whether you’re building out your strategy, prototyping solutions, or bringing your digital portfolio to market, feel free to reach out. We love to exchange ideas on how to address changing markets.