Download PDF

Enhancing Customer Experience Through Data-Driven Solutions: A Case Study of Teradata and Celebrus

Technology Category

- Analytics & Modeling - Machine Learning

- Analytics & Modeling - Real Time Analytics

Applicable Industries

- Finance & Insurance

- Retail

Applicable Functions

- Sales & Marketing

Use Cases

- Real-Time Location System (RTLS)

- Track & Trace of Assets

The Challenge

The case study presents three different enterprises: a Top-5 Global Retail Bank, a UK Retailer, and a European Multiline Insurer, each facing unique challenges in enhancing their customer experience (CX). The bank was struggling with personalizing CX, requiring more granular detail in their data and analytics, and managing CX across all their digital channels. The UK Retailer was unable to maximize customer relationships due to a lack of insight into their customers' online activities. Their aggregated data was always 24 hours out of date, and they could only infer what customers wanted based on past behavior. The European Multiline Insurer was finding it difficult to capture insights from customers self-serving online. The limited data they had was typically 48 hours old, making it impossible to react to customers in the moment.

The Customer

Not disclosed

About The Customer

The customers in this case study are a Top-5 Global Retail Bank, a UK Retailer, and a European Multiline Insurer. The bank was facing challenges in personalizing customer experience and managing it across all their digital channels. The UK Retailer was struggling with outdated aggregated data and a lack of granular digital data, which hindered their ability to understand and cater to their customers' needs. The European Multiline Insurer was having difficulty capturing insights from customers self-serving online due to the limited and outdated data they had.

The Solution

All three enterprises turned to Teradata Vantage™ with Celebrus technology to improve their digital identity management and enhance overall CX. The bank used Celebrus to identify customers and package this into a dataset that was then put into a pre-built Customer Service Data Model within Vantage. Teradata applied AI and machine learning to figure out customer needs and made recommendations in real time. The UK Retailer used real-time Celebrus collection of customer data that was streamed into Vantage. The retailer could measure behavior directly in real time and know what customers were searching or browsing for right now via web, mobile, email, or SMS. The European Multiline Insurer deployed Celebrus to identify digital visitors and capture insights in real time. Teradata Vantage was deployed to support real-time decisioning and messaging. The solution was deployed in the cloud to enable rapid delivery of capability.

Operational Impact

Quantitative Benefit

Related Case Studies.

Case Study

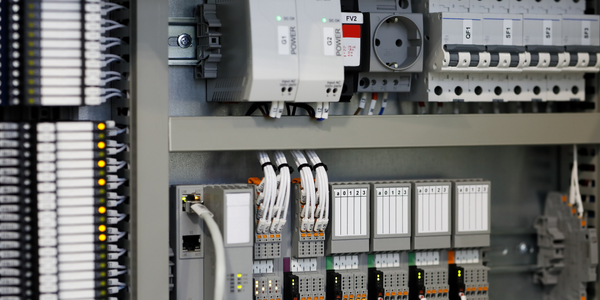

Improving Production Line Efficiency with Ethernet Micro RTU Controller

Moxa was asked to provide a connectivity solution for one of the world's leading cosmetics companies. This multinational corporation, with retail presence in 130 countries, 23 global braches, and over 66,000 employees, sought to improve the efficiency of their production process by migrating from manual monitoring to an automatic productivity monitoring system. The production line was being monitored by ABB Real-TPI, a factory information system that offers data collection and analysis to improve plant efficiency. Due to software limitations, the customer needed an OPC server and a corresponding I/O solution to collect data from additional sensor devices for the Real-TPI system. The goal is to enable the factory information system to more thoroughly collect data from every corner of the production line. This will improve its ability to measure Overall Equipment Effectiveness (OEE) and translate into increased production efficiencies. System Requirements • Instant status updates while still consuming minimal bandwidth to relieve strain on limited factory networks • Interoperable with ABB Real-TPI • Small form factor appropriate for deployment where space is scarce • Remote software management and configuration to simplify operations

Case Study

How Sirqul’s IoT Platform is Crafting Carrefour’s New In-Store Experiences

Carrefour Taiwan’s goal is to be completely digital by end of 2018. Out-dated manual methods for analysis and assumptions limited Carrefour’s ability to change the customer experience and were void of real-time decision-making capabilities. Rather than relying solely on sales data, assumptions, and disparate systems, Carrefour Taiwan’s CEO led an initiative to find a connected IoT solution that could give the team the ability to make real-time changes and more informed decisions. Prior to implementing, Carrefour struggled to address their conversion rates and did not have the proper insights into the customer decision-making process nor how to make an immediate impact without losing customer confidence.

Case Study

Digital Retail Security Solutions

Sennco wanted to help its retail customers increase sales and profits by developing an innovative alarm system as opposed to conventional connected alarms that are permanently tethered to display products. These traditional security systems were cumbersome and intrusive to the customer shopping experience. Additionally, they provided no useful data or analytics.

Case Study

Real-time In-vehicle Monitoring

The telematic solution provides this vital premium-adjusting information. The solution also helps detect and deter vehicle or trailer theft – as soon as a theft occurs, monitoring personnel can alert the appropriate authorities, providing an exact location.“With more and more insurance companies and major fleet operators interested in monitoring driver behaviour on the grounds of road safety, efficient logistics and costs, the market for this type of device and associated e-business services is growing rapidly within Italy and the rest of Europe,” says Franco.“The insurance companies are especially interested in the pay-per-use and pay-as-you-drive applications while other organisations employ the technology for road user charging.”“One million vehicles in Italy currently carry such devices and forecasts indicate that the European market will increase tenfold by 2014.However, for our technology to work effectively, we needed a highly reliable wireless data network to carry the information between the vehicles and monitoring stations.”

Case Study

Ensures Cold Milk in Your Supermarket

As of 2014, AK-Centralen has over 1,500 Danish supermarkets equipped, and utilizes 16 operators, and is open 24 hours a day, 365 days a year. AK-Centralen needed the ability to monitor the cooling alarms from around the country, 24 hours a day, 365 days a year. Each and every time the door to a milk cooler or a freezer does not close properly, an alarm goes off on a computer screen in a control building in southwestern Odense. This type of alarm will go off approximately 140,000 times per year, equating to roughly 400 alarms in a 24-hour period. Should an alarm go off, then there is only a limited amount of time to act before dairy products or frozen pizza must be disposed of, and this type of waste can quickly start to cost a supermarket a great deal of money.