Download PDF

LexisNexis® Risk Solutions Supports Retailer’s Omnichannel Vision by Reducing Online Friction for Trusted Customers and Accurately Detecting Fraud

Technology Category

- Analytics & Modeling - Predictive Analytics

- Application Infrastructure & Middleware - Data Exchange & Integration

- Cybersecurity & Privacy - Identity & Authentication Management

Applicable Industries

- Retail

Applicable Functions

- Sales & Marketing

- Business Operation

Use Cases

- Fraud Detection

Services

- System Integration

- Data Science Services

The Challenge

The retailer wanted to better understand the behavior of genuine good users to avoid increasing false positive rates for customers operating on the outliers of what is considered normal behavior. For example, a B2B contractor may have multiple users accessing one account from different locations and devices – a pattern of behavior which could be indicative of fraud for a consumer account. The retailer required a solution which would be able to recognize legitimate users across its varied customer base and promote a frictionless online experience for trusted customers. Streamlining the user experience was a key priority for the retailer, with plans to introduce improved e-commerce capabilities across the customer journey. For example, an expedited checkout process necessitated the need for risk-based decisioning, with the retailer requiring a solution which would protect high risk touchpoints, without compromising the user experience for trusted customers. As fraudsters continue to attempt to monetize stolen credentials, the retailer also required a solution which would accurately detect and block fraudulent transactions in near real time, without adding unnecessary friction for genuine customers.

About The Customer

This large U.S retailer sells a wide range of products and services to a strong customer base across the United States. The retailer identified that consumers were shifting away from bricks-and-mortar stores to the ease and convenience of online shopping. As a result, the retailer identified e-commerce as a major strategic focus and aimed to improve e-commerce capabilities and create an omnichannel experience across the customer journey. With LexisNexis® Risk Solutions, the retailer achieved a streamlined, secure, end-to-end customer experience by effectively differentiating between genuine customers and fraudsters in near real time, enhancing its recognition of trusted customers, and reducing fraud and false positives.

The Solution

Leveraging the LexisNexis® Digital Identity Network®, the retailer can more effectively build a profile of trusted customer behavior; reducing false positives, and better detecting genuine fraud across the entire customer journey. Delivering a complete, end-to-end solution, LexisNexis helps the retailer instantly recognize legitimate customers and more accurately detect high-risk transactions across key touchpoints in the customer journey, including logins, password reset, and new account origination. LexisNexis® Risk Solutions policy engine allows the retailer to tailor and optimize rules to its customer base, enhancing the identification of trusted users across distinct groups, such as B2B contractors and consumers. Global shared intelligence from the LexisNexis® Digital Identity Network enables the retailer to authenticate every transaction against a trusted and unique online digital identity, checking whether the device, location and behavior of the customer correlates with anonymized information held in the network. The LexisNexis Digital Identity Network harnesses global shared intelligence from millions of daily consumer interactions including logins, payments and new account creations. Using this information, LexisNexis® Risk Solutions creates a unique digital identity for each user by analyzing the myriad connections between devices, locations and anonymized personal information.

Operational Impact

Quantitative Benefit

Related Case Studies.

Case Study

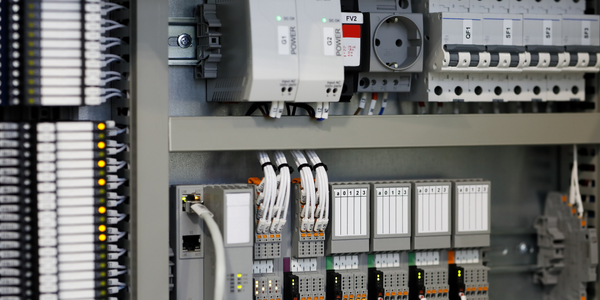

Improving Production Line Efficiency with Ethernet Micro RTU Controller

Moxa was asked to provide a connectivity solution for one of the world's leading cosmetics companies. This multinational corporation, with retail presence in 130 countries, 23 global braches, and over 66,000 employees, sought to improve the efficiency of their production process by migrating from manual monitoring to an automatic productivity monitoring system. The production line was being monitored by ABB Real-TPI, a factory information system that offers data collection and analysis to improve plant efficiency. Due to software limitations, the customer needed an OPC server and a corresponding I/O solution to collect data from additional sensor devices for the Real-TPI system. The goal is to enable the factory information system to more thoroughly collect data from every corner of the production line. This will improve its ability to measure Overall Equipment Effectiveness (OEE) and translate into increased production efficiencies. System Requirements • Instant status updates while still consuming minimal bandwidth to relieve strain on limited factory networks • Interoperable with ABB Real-TPI • Small form factor appropriate for deployment where space is scarce • Remote software management and configuration to simplify operations

Case Study

How Sirqul’s IoT Platform is Crafting Carrefour’s New In-Store Experiences

Carrefour Taiwan’s goal is to be completely digital by end of 2018. Out-dated manual methods for analysis and assumptions limited Carrefour’s ability to change the customer experience and were void of real-time decision-making capabilities. Rather than relying solely on sales data, assumptions, and disparate systems, Carrefour Taiwan’s CEO led an initiative to find a connected IoT solution that could give the team the ability to make real-time changes and more informed decisions. Prior to implementing, Carrefour struggled to address their conversion rates and did not have the proper insights into the customer decision-making process nor how to make an immediate impact without losing customer confidence.

Case Study

Digital Retail Security Solutions

Sennco wanted to help its retail customers increase sales and profits by developing an innovative alarm system as opposed to conventional connected alarms that are permanently tethered to display products. These traditional security systems were cumbersome and intrusive to the customer shopping experience. Additionally, they provided no useful data or analytics.

Case Study

Ensures Cold Milk in Your Supermarket

As of 2014, AK-Centralen has over 1,500 Danish supermarkets equipped, and utilizes 16 operators, and is open 24 hours a day, 365 days a year. AK-Centralen needed the ability to monitor the cooling alarms from around the country, 24 hours a day, 365 days a year. Each and every time the door to a milk cooler or a freezer does not close properly, an alarm goes off on a computer screen in a control building in southwestern Odense. This type of alarm will go off approximately 140,000 times per year, equating to roughly 400 alarms in a 24-hour period. Should an alarm go off, then there is only a limited amount of time to act before dairy products or frozen pizza must be disposed of, and this type of waste can quickly start to cost a supermarket a great deal of money.

Case Study

Supermarket Energy Savings

The client had previously deployed a one-meter-per-store monitoring program. Given the manner in which energy consumption changes with external temperature, hour of the day, day of week and month of year, a single meter solution lacked the ability to detect the difference between a true problem and a changing store environment. Most importantly, a single meter solution could never identify root cause of energy consumption changes. This approach never reduced the number of truck-rolls or man-hours required to find and resolve issues.