Download PDF

Overcoming Data Challenges in FinTech: A Case Study

Technology Category

- Analytics & Modeling - Machine Learning

- Infrastructure as a Service (IaaS) - Hybrid Cloud

Applicable Industries

- Education

- Retail

Use Cases

- Facial Recognition

- Leasing Finance Automation

Services

- Data Science Services

- Training

The Challenge

The Covid-19 pandemic has acted as a catalyst for the FinTech sector, accelerating investments and technological progress. However, data and technology remain significant challenges, hindering further progress for FinTechs and their partnering traditional financial institutions. Among FinTechs globally, 81 percent have reported data to be their biggest technical challenge. These data issues are split between leveraging data for AI-ML (faced by 41 percent) and connecting to customer applications and data systems (faced by 40 percent). Other data issues faced by FinTechs include security (40 percent) and deployment in multiple clouds (39 percent). The consequences of these data issues include trouble innovating further due to a lack of clear picture about the type of products and services that customers require and about the businesses themselves. The inability to connect to customer applications directly impacts the user experience and the ability to offer their present products to the wider customer base. These issues also hinder securing partnerships with incumbent banks, and more seriously, regulatory compliance.

The Customer

FinTech

About The Customer

The customers in this case are FinTech companies, a portmanteau of the terms “financial” and “technology”. These businesses use technology to enhance and automate financial processes, services, and products. Examples of FinTechs include organizations and enterprises such as Venmo, Stripe, PayPal in the payments sector and Challenger banks and Neo banks in the consumer banking sector. The technology powering FinTech products and services varies from project to project, sector to sector, and application to application but examples include machine learning, artificial intelligence, data science, blockchain to power everything from credit risk assessment to automated trading and hedge fund management.

The Solution

To overcome these challenges, FinTechs need to revise their current data management strategy to bridge the data silos and integrate them with the help of a new architectural approach called Data Fabric. Data fabrics access and transform data from multiple datasets to generate insights that allow FinTechs to better understand and serve their customers. Smart data fabrics have built-in business intelligence, analytics, natural language processing, and ML capabilities. Additionally, investing in training and knowledge about the cloud and building cloud-first solutions can alleviate the data issues that FinTechs face in deploying to hybrid cloud. Another solution is the use of one-shot learning models for AI, which allow computers to learn from smaller datasets, a useful approach in case of a lack of access to large amounts of big data that FinTech startups often face.

Operational Impact

Quantitative Benefit

Related Case Studies.

Case Study

Improving Production Line Efficiency with Ethernet Micro RTU Controller

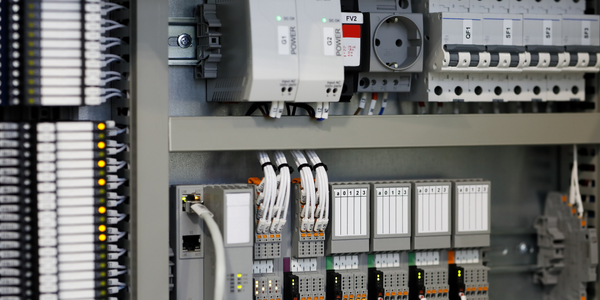

Moxa was asked to provide a connectivity solution for one of the world's leading cosmetics companies. This multinational corporation, with retail presence in 130 countries, 23 global braches, and over 66,000 employees, sought to improve the efficiency of their production process by migrating from manual monitoring to an automatic productivity monitoring system. The production line was being monitored by ABB Real-TPI, a factory information system that offers data collection and analysis to improve plant efficiency. Due to software limitations, the customer needed an OPC server and a corresponding I/O solution to collect data from additional sensor devices for the Real-TPI system. The goal is to enable the factory information system to more thoroughly collect data from every corner of the production line. This will improve its ability to measure Overall Equipment Effectiveness (OEE) and translate into increased production efficiencies. System Requirements • Instant status updates while still consuming minimal bandwidth to relieve strain on limited factory networks • Interoperable with ABB Real-TPI • Small form factor appropriate for deployment where space is scarce • Remote software management and configuration to simplify operations

Case Study

How Sirqul’s IoT Platform is Crafting Carrefour’s New In-Store Experiences

Carrefour Taiwan’s goal is to be completely digital by end of 2018. Out-dated manual methods for analysis and assumptions limited Carrefour’s ability to change the customer experience and were void of real-time decision-making capabilities. Rather than relying solely on sales data, assumptions, and disparate systems, Carrefour Taiwan’s CEO led an initiative to find a connected IoT solution that could give the team the ability to make real-time changes and more informed decisions. Prior to implementing, Carrefour struggled to address their conversion rates and did not have the proper insights into the customer decision-making process nor how to make an immediate impact without losing customer confidence.

Case Study

Digital Retail Security Solutions

Sennco wanted to help its retail customers increase sales and profits by developing an innovative alarm system as opposed to conventional connected alarms that are permanently tethered to display products. These traditional security systems were cumbersome and intrusive to the customer shopping experience. Additionally, they provided no useful data or analytics.

Case Study

Ensures Cold Milk in Your Supermarket

As of 2014, AK-Centralen has over 1,500 Danish supermarkets equipped, and utilizes 16 operators, and is open 24 hours a day, 365 days a year. AK-Centralen needed the ability to monitor the cooling alarms from around the country, 24 hours a day, 365 days a year. Each and every time the door to a milk cooler or a freezer does not close properly, an alarm goes off on a computer screen in a control building in southwestern Odense. This type of alarm will go off approximately 140,000 times per year, equating to roughly 400 alarms in a 24-hour period. Should an alarm go off, then there is only a limited amount of time to act before dairy products or frozen pizza must be disposed of, and this type of waste can quickly start to cost a supermarket a great deal of money.

Case Study

Supermarket Energy Savings

The client had previously deployed a one-meter-per-store monitoring program. Given the manner in which energy consumption changes with external temperature, hour of the day, day of week and month of year, a single meter solution lacked the ability to detect the difference between a true problem and a changing store environment. Most importantly, a single meter solution could never identify root cause of energy consumption changes. This approach never reduced the number of truck-rolls or man-hours required to find and resolve issues.