下载PDF

AI-Driven Customer Engagement: Tata Mutual Fund's Success Story

技术

- 平台即服务 (PaaS) - 应用开发平台

适用行业

- 零售

适用功能

- 销售与市场营销

用例

- 对话机器人

挑战

塔塔共同基金面临的挑战是通过提供更快的查询解决方案并最大限度地减少人为干预来改善客户体验。他们希望每月的客户呼叫量减少 70%,并且需要一个可以与现有客户支持基础设施集成的人工智能驱动的解决方案。

关于客户

塔塔共同基金是塔塔集团的一部分,是印度最值得信赖的基金公司。他们为财务规划和财富创造提供一系列投资解决方案。他们希望更好地为需要随时随地支持的数字优先千禧一代提供服务。

解决方案

Haptik 通过实施虚拟助理聊天机器人提供了解决方案,帮助塔塔共同基金端到端地解决日常查询,使代理能够专注于高价值问题。聊天机器人与后端系统集成,确保有效的信息传播,以便立即跟进和关闭。它还为客户提供简单查询的自动答案,同时仍然允许代理在需要时进行干预。

运营影响

数量效益

相关案例.

Case Study

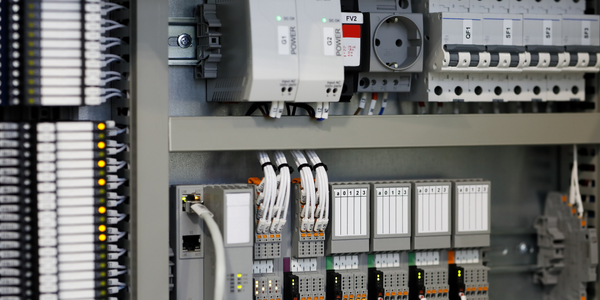

Improving Production Line Efficiency with Ethernet Micro RTU Controller

Moxa was asked to provide a connectivity solution for one of the world's leading cosmetics companies. This multinational corporation, with retail presence in 130 countries, 23 global braches, and over 66,000 employees, sought to improve the efficiency of their production process by migrating from manual monitoring to an automatic productivity monitoring system. The production line was being monitored by ABB Real-TPI, a factory information system that offers data collection and analysis to improve plant efficiency. Due to software limitations, the customer needed an OPC server and a corresponding I/O solution to collect data from additional sensor devices for the Real-TPI system. The goal is to enable the factory information system to more thoroughly collect data from every corner of the production line. This will improve its ability to measure Overall Equipment Effectiveness (OEE) and translate into increased production efficiencies. System Requirements • Instant status updates while still consuming minimal bandwidth to relieve strain on limited factory networks • Interoperable with ABB Real-TPI • Small form factor appropriate for deployment where space is scarce • Remote software management and configuration to simplify operations

Case Study

How Sirqul’s IoT Platform is Crafting Carrefour’s New In-Store Experiences

Carrefour Taiwan’s goal is to be completely digital by end of 2018. Out-dated manual methods for analysis and assumptions limited Carrefour’s ability to change the customer experience and were void of real-time decision-making capabilities. Rather than relying solely on sales data, assumptions, and disparate systems, Carrefour Taiwan’s CEO led an initiative to find a connected IoT solution that could give the team the ability to make real-time changes and more informed decisions. Prior to implementing, Carrefour struggled to address their conversion rates and did not have the proper insights into the customer decision-making process nor how to make an immediate impact without losing customer confidence.

Case Study

Digital Retail Security Solutions

Sennco wanted to help its retail customers increase sales and profits by developing an innovative alarm system as opposed to conventional connected alarms that are permanently tethered to display products. These traditional security systems were cumbersome and intrusive to the customer shopping experience. Additionally, they provided no useful data or analytics.

Case Study

Ensures Cold Milk in Your Supermarket

As of 2014, AK-Centralen has over 1,500 Danish supermarkets equipped, and utilizes 16 operators, and is open 24 hours a day, 365 days a year. AK-Centralen needed the ability to monitor the cooling alarms from around the country, 24 hours a day, 365 days a year. Each and every time the door to a milk cooler or a freezer does not close properly, an alarm goes off on a computer screen in a control building in southwestern Odense. This type of alarm will go off approximately 140,000 times per year, equating to roughly 400 alarms in a 24-hour period. Should an alarm go off, then there is only a limited amount of time to act before dairy products or frozen pizza must be disposed of, and this type of waste can quickly start to cost a supermarket a great deal of money.

Case Study

Supermarket Energy Savings

The client had previously deployed a one-meter-per-store monitoring program. Given the manner in which energy consumption changes with external temperature, hour of the day, day of week and month of year, a single meter solution lacked the ability to detect the difference between a true problem and a changing store environment. Most importantly, a single meter solution could never identify root cause of energy consumption changes. This approach never reduced the number of truck-rolls or man-hours required to find and resolve issues.