Download PDF

Accelerating Bank Processes with IoT: A Case Study of Landsbankinn

Technology Category

- Application Infrastructure & Middleware - Event-Driven Application

- Cybersecurity & Privacy - Security Compliance

Applicable Industries

- Finance & Insurance

- Retail

Applicable Functions

- Human Resources

- Quality Assurance

Use Cases

- Leasing Finance Automation

- Time Sensitive Networking

Services

- System Integration

The Challenge

Landsbankinn, the largest bank in Iceland, was grappling with outdated, manual, and paper-based processes that were slowing down its operations and affecting customer service. The bank's back-office banking processes had remained unchanged for years, relying heavily on paper forms that had to be physically moved around the organization. This was particularly evident in the loan authorization process for employees, which involved multiple departments and took up to five days to complete. Additionally, the bank's reliance on handwritten signatures for loan applications was inconvenient for customers and slowed down the process. The HR department also faced challenges managing requests from over 900 employees, as the paper-based system was prone to loss and delays. Lastly, the bank needed to ensure strict compliance with national and international financial regulations, including the GDPR.

About The Customer

Landsbankinn is the largest bank in Iceland, serving 143,000 retail and corporate customers. The bank operates with a vision to be exemplary in everything it does, continually enhancing customer satisfaction and loyalty, and improving operational efficiency. It has over 900 employees working at its headquarters in Reykjavik and 37 branches across the country. The bank operates in a strict regulatory environment and needs to comply with numerous national and international financial industry regulations, including the GDPR.

The Solution

Landsbankinn turned to Nintex K2 Five to automate its processes. The bank developed over 40 automated solutions, significantly speeding up services for customers and improving back-office banking and HR operations. For loan authorizations, the bank created automated processes that reduced the time from five days to just one. The bank also introduced digital signatures, allowing customers to sign documents online, thereby speeding up the loan application process. The HR department used K2 Five to transform paper-based processes into automated digital ones, enabling faster approval of HR requests. To ensure regulatory compliance, Landsbankinn used K2 Software to ensure all steps in every process adhered to relevant regulations. This included a workflow to manage customer requests for personal information, ensuring compliance with GDPR.

Operational Impact

Quantitative Benefit

Related Case Studies.

Case Study

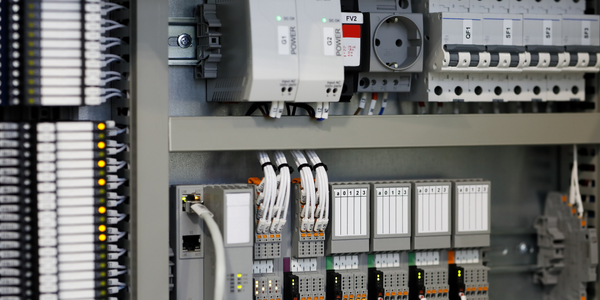

Improving Production Line Efficiency with Ethernet Micro RTU Controller

Moxa was asked to provide a connectivity solution for one of the world's leading cosmetics companies. This multinational corporation, with retail presence in 130 countries, 23 global braches, and over 66,000 employees, sought to improve the efficiency of their production process by migrating from manual monitoring to an automatic productivity monitoring system. The production line was being monitored by ABB Real-TPI, a factory information system that offers data collection and analysis to improve plant efficiency. Due to software limitations, the customer needed an OPC server and a corresponding I/O solution to collect data from additional sensor devices for the Real-TPI system. The goal is to enable the factory information system to more thoroughly collect data from every corner of the production line. This will improve its ability to measure Overall Equipment Effectiveness (OEE) and translate into increased production efficiencies. System Requirements • Instant status updates while still consuming minimal bandwidth to relieve strain on limited factory networks • Interoperable with ABB Real-TPI • Small form factor appropriate for deployment where space is scarce • Remote software management and configuration to simplify operations

Case Study

How Sirqul’s IoT Platform is Crafting Carrefour’s New In-Store Experiences

Carrefour Taiwan’s goal is to be completely digital by end of 2018. Out-dated manual methods for analysis and assumptions limited Carrefour’s ability to change the customer experience and were void of real-time decision-making capabilities. Rather than relying solely on sales data, assumptions, and disparate systems, Carrefour Taiwan’s CEO led an initiative to find a connected IoT solution that could give the team the ability to make real-time changes and more informed decisions. Prior to implementing, Carrefour struggled to address their conversion rates and did not have the proper insights into the customer decision-making process nor how to make an immediate impact without losing customer confidence.

Case Study

Digital Retail Security Solutions

Sennco wanted to help its retail customers increase sales and profits by developing an innovative alarm system as opposed to conventional connected alarms that are permanently tethered to display products. These traditional security systems were cumbersome and intrusive to the customer shopping experience. Additionally, they provided no useful data or analytics.

Case Study

Real-time In-vehicle Monitoring

The telematic solution provides this vital premium-adjusting information. The solution also helps detect and deter vehicle or trailer theft – as soon as a theft occurs, monitoring personnel can alert the appropriate authorities, providing an exact location.“With more and more insurance companies and major fleet operators interested in monitoring driver behaviour on the grounds of road safety, efficient logistics and costs, the market for this type of device and associated e-business services is growing rapidly within Italy and the rest of Europe,” says Franco.“The insurance companies are especially interested in the pay-per-use and pay-as-you-drive applications while other organisations employ the technology for road user charging.”“One million vehicles in Italy currently carry such devices and forecasts indicate that the European market will increase tenfold by 2014.However, for our technology to work effectively, we needed a highly reliable wireless data network to carry the information between the vehicles and monitoring stations.”

Case Study

Ensures Cold Milk in Your Supermarket

As of 2014, AK-Centralen has over 1,500 Danish supermarkets equipped, and utilizes 16 operators, and is open 24 hours a day, 365 days a year. AK-Centralen needed the ability to monitor the cooling alarms from around the country, 24 hours a day, 365 days a year. Each and every time the door to a milk cooler or a freezer does not close properly, an alarm goes off on a computer screen in a control building in southwestern Odense. This type of alarm will go off approximately 140,000 times per year, equating to roughly 400 alarms in a 24-hour period. Should an alarm go off, then there is only a limited amount of time to act before dairy products or frozen pizza must be disposed of, and this type of waste can quickly start to cost a supermarket a great deal of money.