Download PDF

Blender's Automation Revolution: Accelerating Loan Processes with Nintex

Technology Category

- Platform as a Service (PaaS) - Application Development Platforms

- Sensors - Autonomous Driving Sensors

Applicable Industries

- Consumer Goods

- Retail

Applicable Functions

- Maintenance

- Procurement

Use Cases

- Leasing Finance Automation

- Smart Parking

Services

- Cloud Planning, Design & Implementation Services

The Challenge

Blender Financial Technologies, a fintech startup based in Israel, aimed to build an automated technology platform devoid of manual work processes. The company, which started in 2014, had the goal of creating a consumer lending platform that was fully integrated, driven by automation, and housed exclusively on the cloud. The challenge was to build an online platform that was efficient, fast, and easy to use, with no manual or offline processes. Being a fintech startup, Blender had the advantage of not having to deal with legacy systems, but the task of creating a platform that was both consumer-friendly and compliant with the regulations of the financial services industry was still a significant challenge.

About The Customer

Blender Financial Technologies is a fintech startup based in Israel. The company was founded in 2014 with the goal of creating a consumer lending platform that was fully integrated, driven by automation, and housed exclusively on the cloud. Blender operates across four countries - Israel, Lithuania, Latvia, and Poland. The company offers a range of consumer lending services through their digital platform including P2P, BNPL, car loans, and bank loans. The business operates online only, with no retail branches. Despite having fewer than 50 employees, Blender services 60,000 customers and processes 2,000 new loans every month.

The Solution

Blender built an online consumer credit platform that transacts peer-to-peer (P2P) lending, Buy Now Pay Later (BNPL), car loans, and bank loans digitally. The platform was built around the cloud, eliminating manual processes. Salesforce was used as the core banking platform and was fully integrated with Nintex DocGen, which was used to manage contract creation. This unique, integrated platform allowed in-house operators to view loan applications through a single-screen interface, rather than having to work across multiple screens from various technology providers. The platform also facilitated fast loan approvals, with a loan from Blender being approved within 30 seconds. Nintex DocGen was used to manage the digital generation of all contracts, which were built directly within Salesforce. Automation enabled over 100,000 contracts to be processed annually.

Operational Impact

Quantitative Benefit

Related Case Studies.

.png)

Case Study

Improving Vending Machine Profitability with the Internet of Things (IoT)

The vending industry is undergoing a sea change, taking advantage of new technologies to go beyond just delivering snacks to creating a new retail location. Intelligent vending machines can be found in many public locations as well as company facilities, selling different types of goods and services, including even computer accessories, gold bars, tickets, and office supplies. With increasing sophistication, they may also provide time- and location-based data pertaining to sales, inventory, and customer preferences. But at the end of the day, vending machine operators know greater profitability is driven by higher sales and lower operating costs.

Case Study

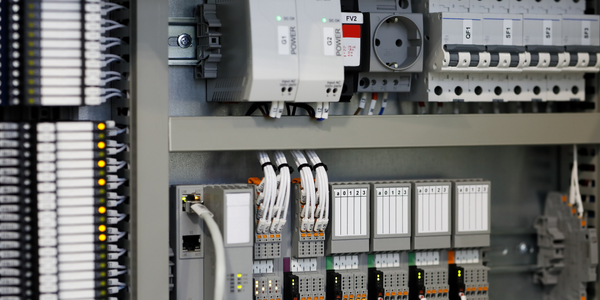

Improving Production Line Efficiency with Ethernet Micro RTU Controller

Moxa was asked to provide a connectivity solution for one of the world's leading cosmetics companies. This multinational corporation, with retail presence in 130 countries, 23 global braches, and over 66,000 employees, sought to improve the efficiency of their production process by migrating from manual monitoring to an automatic productivity monitoring system. The production line was being monitored by ABB Real-TPI, a factory information system that offers data collection and analysis to improve plant efficiency. Due to software limitations, the customer needed an OPC server and a corresponding I/O solution to collect data from additional sensor devices for the Real-TPI system. The goal is to enable the factory information system to more thoroughly collect data from every corner of the production line. This will improve its ability to measure Overall Equipment Effectiveness (OEE) and translate into increased production efficiencies. System Requirements • Instant status updates while still consuming minimal bandwidth to relieve strain on limited factory networks • Interoperable with ABB Real-TPI • Small form factor appropriate for deployment where space is scarce • Remote software management and configuration to simplify operations

Case Study

How Sirqul’s IoT Platform is Crafting Carrefour’s New In-Store Experiences

Carrefour Taiwan’s goal is to be completely digital by end of 2018. Out-dated manual methods for analysis and assumptions limited Carrefour’s ability to change the customer experience and were void of real-time decision-making capabilities. Rather than relying solely on sales data, assumptions, and disparate systems, Carrefour Taiwan’s CEO led an initiative to find a connected IoT solution that could give the team the ability to make real-time changes and more informed decisions. Prior to implementing, Carrefour struggled to address their conversion rates and did not have the proper insights into the customer decision-making process nor how to make an immediate impact without losing customer confidence.

Case Study

Digital Retail Security Solutions

Sennco wanted to help its retail customers increase sales and profits by developing an innovative alarm system as opposed to conventional connected alarms that are permanently tethered to display products. These traditional security systems were cumbersome and intrusive to the customer shopping experience. Additionally, they provided no useful data or analytics.